The U.S. Senate approved a House bill June 3 that adds needed flexibility to the Paycheck Protection Program.

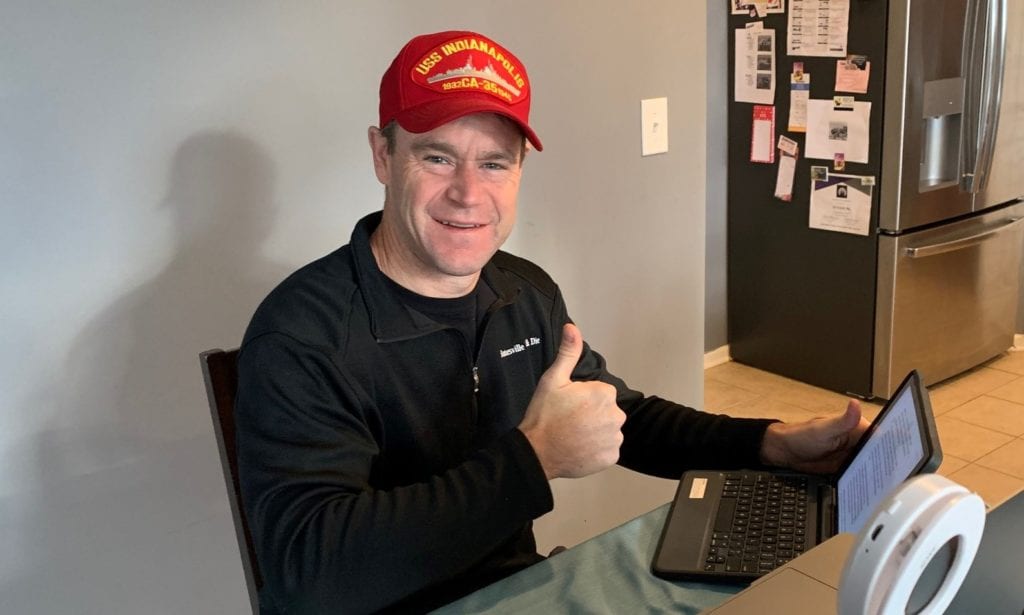

The action, by unanimous consent, happened only hours after Home Furnishings Association members urged Sen. Todd Young of Indiana and his colleagues to move quickly.

“I will carry that message to those who have not internalized that perfection is not an option here,” Young told HFA’s Government Relations Action Team. The Paycheck Protection Program Flexibility Act had some flaws, he said, but passage couldn’t wait.

“Two million loans come due this week, so we’ve got to get that done,” Young said.

President Donald Trump signed the bill June 5.

Young was introduced to the HFA team by member Jim Kittle, chairman of Kittle’s Furniture in Indianapolis.

Eight-week period was unrealistic

Many – possibly most – HFA members secured PPP loans created by Congress to carry small businesses through the economic downturn caused by the coronavirus crisis. The program allows for loan forgiveness but required spending funds, mostly for payroll, within eight weeks of receiving funds.

“Let me acknowledge that because we acted quickly on the PPP, its structure had some, and still has some, infirmities,” Young told the HFA group. “So the time to deploy those monies, for payroll or fixed operating costs, only being eight weeks, well, we had hoped that after an eight-week time period, things would kind of resume as normal. That wasn’t the case and won’t be the case. We need to recognize that.”

HFA quickly saw the problem, as many furniture retailers remained closed under state orders as the clock was ticking on their eight-week window to spend loan money. Making it worse, three-fourths of the funds had to be allocated to payroll in order to earn loan forgiveness. Many retailers had to put employees on furlough while stores were closed.

What are the key changes?

These are key changes, according to AICPA:

- Current PPP borrowers can choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. New PPP borrowers will have a 24-week covered period, but the covered period can’t extend beyond Dec. 31, 2020. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

- The payroll expenditure requirement drops to 60 percent from 75 percent but is now a cliff, meaning that borrowers must spend at least 60 percent on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75 percent of eligible funds are used for payroll costs, but forgiveness isn’t eliminated if the 75 percent threshold isn’t met. It’s possible Congress will make a technical correction that could restore a sliding scale for forgiveness.

- Borrowers can use the 24-week period to restore their workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

- The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce. Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good-faith offers to be rehired at the same hours and wages as before the pandemic. The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- New borrowers now have five years to repay unforgiven portions of the loan instead of two. Existing PPP loans can be extended up to five years if the lender and borrower agree. The interest rate remains at 1 percent.

- The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

HFA members should contact their lenders to make adjustments to the administration of their PPP loans in light of these changes.

More help will be needed, senator says

This is a very positive step, but Young said many businesses will still need more help.

“We all hope consumer demand races back, but there are some businesses where it’s going to take some time,” he told HFA members. “There are going to be some businesses where it’s going to take some time for demand to come back and to justify bringing back all your employees.”

That’s why he and Sen. Michael Bennet of Colorado introduced the RESTART Act, which would create a new lending vehicle with built-in flexibility.

“We think this will provide a lot more certainty and frankly a lifeline to so many businesses between now and year’s end,” Young said. “This would expire at year’s end. It would be a seven-year loan.”

While the PPP generally was available only to businesses with fewer than 500 employees, the Young-Bennet proposal would lend up to $12 million to businesses with as many as 5,000 employees. Borrowers could use the funds as needed. “There’s no requirement to increase staffing beyond what business conditions dictate,” Young said. The amount of loan forgiveness available would be determined based on loss of revenue compared to 2019.

Liability protection is a top priority

Young predicted a further response by Congress after its July 4 recess. Two actions are especially needed, he said:

- Reducing the current federal unemployment subsidy of $600 per week, which creates a disincentive to work, but possibly replacing some of that benefit with wage subsidies to help businesses lure employees back to work.

- And providing coronavirus-related liability protection for businesses.

“That’s the No. 1 priority that Republicans have, is ensuring that we get liability protection in the next phase of our federal response,” Young said. “We’re already seeing in the news that lawyers are starting to fire up their engines on this one.”

The senator noted that several states already have enacted liability protection, and the role of Congress is to provide “a federal backstop.”

Liability protection is a priority for the HFA as well.

A time for ‘bold action’ by government

The federal role, with several trillion dollars already spent to shore up a sagging economy, has been greater than Young, a Republican, normally would want to see.

“I’m a limited government sort of U.S. senator,” he said, “but I do believe there are times for government, and I think there are times for bold action by government.”

This is such a time, when the country is trying to overcome a pandemic, a suddenly weak economy and, since last week, civil unrest. But Young remains optimistic.

“We’re going to get through this,” the former U.S. Marine Corps captain said. “There’s no doubt we are.”