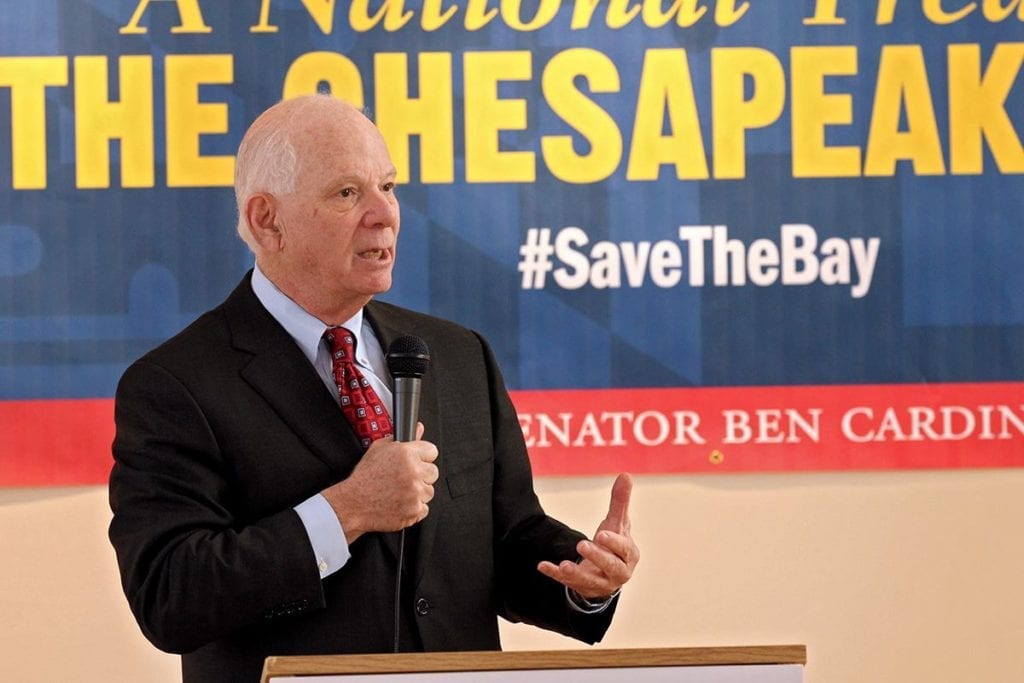

Congress really wants small businesses to keep borrowing through the Paycheck Protection Program. By unanimous consent Tuesday, the Senate agreed to a measure introduced by Sen. Ben Cardin (D-Md.) extending the popular lending program to Aug. 8.

Late this afternoon, the House of Representatives took similar action. The PPP hit its scheduled deadline for new loans Tuesday night, but, with some $130 billion still unused, it has been given new life today. The extension will be official when it is signed by President Donald Trump.

Home Furnishings Association members who have not yet participated will get another chance – and they should strongly consider applying for a loan.

The program delivered some 4.6 million loans through private lenders. Nearly two-thirds of loans were for $50,000 or less, while the average loan was $112,000, according to the Small Business Administration. The program was generally targeted at businesses with fewer than 500 employees.

Its original parameters were tightly drawn. Loan funds had to be spent within eight weeks of receipt, and at least 70 percent had to be applied to payroll costs in order to earn forgiveness. Amounts not forgiven would have to be repaid within two years.

HFA pushed for changes to lending program

In conversations with and letters to lawmakers, including Sen. Cardin, the HFA pointed out flaws in this formula. Many furniture retailers were forced to close their stores during the eight-week loan period, making it impractical or not helpful to spend the money for payroll. Congress eventually enacted a new measure – the Paycheck Protection Program Flexibility Act. It extended the loan period until the end of the year and dropped the threshold for payroll costs to 60 percent. New loans would have a term of five years rather than two. But, new loans would still only be granted until June 30.

The extension to Aug. 8 by itself won’t change the provisions set out in the Paycheck Protection Program Flexibility Act. So, Congress should make at least two important revisions:

- Allow borrowers to apply for a second loan since the original eight-week restriction limited the benefits for many businesses.

- And grant even more flexibility for spending loan funds. Businesses themselves know best how to use the money most effectively.

Improved PPP offers good terms for retailers

Many HFA members secured PPP loans as they struggled to keep workers employed and to pay other bills. Some did not, perhaps relying on another program, the Economic Injury Disaster Loan. Receiving an EIDL does not preclude a qualified business from applying for a PPP loan.

New PPP loans, now available until Aug. 8, can be spent through the end of the year. If just 60 percent is spent on payroll, and no more than 40 percent for mortgage interest, rent or utilities, the loan can be forgiven. Any amount not forgiven can be repaid over five years at just 1 percent interest. It is worth considering.