The Home Furnishings Association and other trade groups pushed hard for an important tax fix all through 2019. It was finally included in the Coronavirus Aid, Relief and Economic Security Act because it can give furniture stores, grocery stores, restaurants, hotels and other retail businesses a financial boost. President Donald Trump signed the CARES Act March 27.

The 2017 Tax Cuts and Jobs Act intended to grant bonus depreciation for qualified improvement property, or QIP. It was defined as “any improvement made by the taxpayer to an interior portion of a building which is nonresidential real property.” The intent was to allow, for example, a furniture store owner to add lighting, replace a floor or remodel the showroom to claim a deduction for the entire cost in the year funds were spent.

Instead, a drafting error created a depreciation period of 39 years, eliminating any meaningful benefit.

House and Senate bills that would have corrected the error were introduced in early 2019 and gathered strong bipartisan support. But House and Senate leaders refused to let the legislation advance.

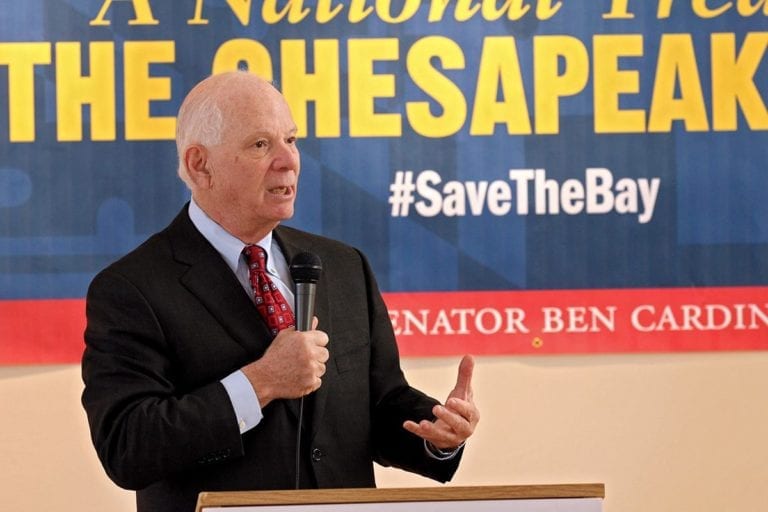

Congressional leaders see tax benefit

That changed when Congress began to consider ways to help businesses weather the coronavirus crisis. So, it included the QIP revision in the CARES Act. It not only corrects the error, it allows businesses to file amended returns for 2018 and 2019 to claim the deduction and receive refunds of taxes already paid because of the mistake.

[Retailers get tax help in CARES Act]

On April 17, the Internal Revenue Service published instructions for seeking that refund. Taxpayers can make an administrative adjustment request using Form 3115, Application for Change in Accounting Method, according to Sally P. Schreiber in The Tax Adviser.

“Additionally,” professional services firm CohnReznick writes, “for the 2018, 2019, or 2020 tax years, this revenue procedure allows a taxpayer to make a late election, or to revoke or withdraw an election, under the following sections:

- Section 168(g)(7) [use of the alternative depreciation system (ADS)].

- Section 168(k)(7) [election out of bonus depreciation].

Generally, these are the options

“In order to change depreciation under Section 168 for QIP and/or to make a late election or revoke an election under Section 168(g)(7) or (k)(7) per the above, generally taxpayers may do the following:

- File an amended tax return.

- File Form 3115, “Application for Change in Accounting Method.”

- Or file an AAR (in the case of a BBA partnership).

“Note that the withdrawal of an election under Section 168(g)(7) may only be done by filing an amended return or AAR, not by filing a Form 3115.”

For filing Form 3115

For filing Form 3115, CohnReznick advises, this “modifies Revenue Procedure 2019-43 by adding two new automatic method changes:

- The designated change number (DCN) 244 covers the changes in depreciation of QIP placed in service after Dec. 31, 2017.

- The DCN 245 covers the changes associated with making a late election out of bonus depreciation, revoking an ‘election out’ of bonus depreciation and/or a late election to use ADS.

“Under these new sections, Form 3115 has reduced filing requirements, and certain eligibility rules are temporarily inapplicable.”

An accountant can help. What’s important is that a tax refund is possible for qualifying interior improvements made during the past two years, and that there is now a true tax incentive to make similar upgrades in the next couple of years.

[HFA thanks lawmakers for critical tax fix]